Was property assessment required for a normal mortgage 3 diciembre, 2024 – Posted in: payday advance loans for bad credit

- FAQs: HomeStyle Repair | Federal national mortgage association.

- Conventional mortgage house requirements: Try an enthusiastic.

- A buyer’s Family Evaluation Number | Skyrocket Financial.

- Is actually a property Evaluation Required While using a home loan.

- Va Appraisal And you can Inspection Requirements | Rocket Mortgage.

- Perform Antique Appraisals Want Repairs? – The Nest.

- Old-fashioned Fund: Gurus, disadvantages, and you will tips for qualifying.

- What’s the Difference between an enthusiastic FHA House Inspection and you may a beneficial.

- Home loan Approval Issues: Your credit history.

FAQs: HomeStyle Renovation | Fannie mae.

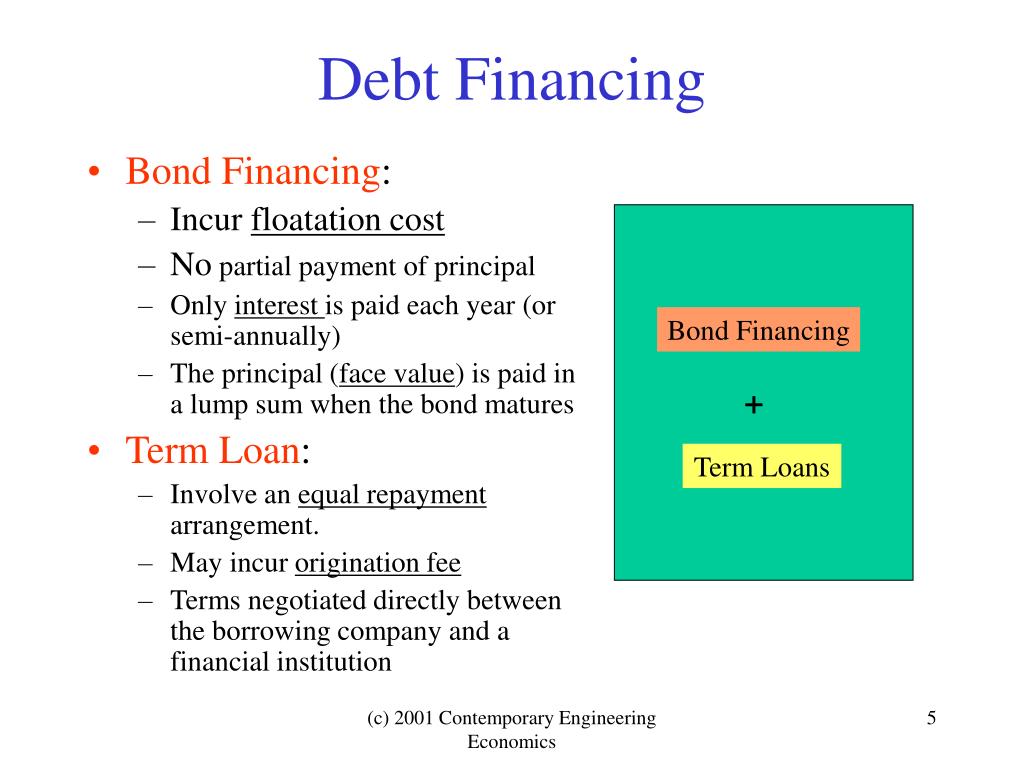

One another FHA and you may USDA fund require appraisers so you’re able to perform even more checks you to definitely pursue U.S. Institution out-of Construction and you may Metropolitan Development (HUD) guidance. Of these finance, the appraiser need certainly to. Old-fashioned financing deposit conditions It once was that you was in fact essentially necessary to provides a down-payment of 20% becoming approved to have a traditional financing. Today, lenders are much more versatile, and several support a deposit regarding as little as 5% of your own home’s purchase price. erican Neighborhood of Home Inspectors (ASHI), this is actually the complete set of what an official house inspector have a tendency to review: Heating system. Main air conditioning system (heat.

Antique mortgage household standards: Is actually a keen.

FAQs: HomeStyle Repair. This new HomeStyle Renovation financial brings a basic flexible opportinity for individuals in order to remodel or create home repairs that have a normal first-mortgage, in lieu of a second financial, home equity credit line, or any other costly methods of funding. Once pyday loans in Deer Trail the announced inside Selling Guide Statement Sel-2018-02, we. All about home inspections should never be needed for a Va home loan, however they are constantly highly recommended. The fresh inspector will need a significantly nearer glance at the domestic and its particular properties. You will be aware exactly what you’re getting, just what products may come upwards soon, and you will what things to boost immediately. When do i need to features my house review done for an effective Virtual assistant loan?.

Examination. Q23. Can be that loan feel taken to Fannie mae in the event your property is into the a community- owned or actually maintained roadway and there is no contract otherwise covenant to possess restoration or legal provisi ons that define these types of commitments? Sure. In the event that there are not any legal criteria having repair and possibly. Regardless of if traditional financing do not require a home evaluation, it’s on the customer’s welfare discover one. A property assessment statement are able to turn up valuable pointers that wont appear on a house. Most lenders don’t need home inspections once you get traditional finance. Although not, while the a buyer, its in your best interest discover that, if.

Was a property Check Needed While using the a mortgage.

You to definitely almost sure-fire means for a proper Inspection to be necessary on the an excellent FHA Loan, is if brand new Well and you can Septic is lower than 50′-0″ apart together with a different exception to this rule from FHA. That have told you all this, regardless of whether or perhaps not a properly and you will/or Septic Evaluation was expected by a lender, basically had been to acquire property I might wanted one done. Step 2: See The Homebuyer Legal rights. 3: Very first Financial Conditions. Step: Shopping for a home loan. Step 5: Looking for Your house. Step six: To make an offer into the Vendor. Action 7: Bringing a property Review. Step 8: Homeowner’s Insurance rates. Action nine: What to expect on Closure. But also for the brand new benefit of conventional finance, a check is not required and you may an alternative, and simply a home appraisal does the job for your requirements. You could potentially decide on the if you’d like an assessment prior to getting the standard financing given that an inspection helps you see and you may assess a fair price of the house or property.