Regrettably, financial companies wouldn’t make use of the highest credit rating between your two, might probably think about the lower score 6 diciembre, 2024 – Posted in: how much can i get on a payday loan

Seriously! This could feel like a weird and difficult matter, but there are numerous things inside it when selecting a house in the place of your lady. Let’s simply take Kissimmee, there are various variations to look at if you find yourself wanting virginia homes when you look at the Kissimmee. Can it increase or decrease your taxes? Whether it really does all the way down taxation; it will affect the mortgage and you can later years preparations. Much more savings to you personally!

To buy property versus your spouse can end gaining you. Lenders cannot discriminate facing you to shop for property which have or rather than him/her because of the Equivalent Borrowing Opportunity Work (ECOA). To shop for a property alone can save you Tons of money, challenge and you may big date. Talking about saving a lot of money, definitely get the help of property well worth estimator. If you find yourself looking to purchase property on your title just you can use cover their passion, manage your own possessions and located an excellent mortgage.

Very first Tips when deciding to take

If you plus mate are looking to purchase a good brand new home to one another, thought certain economic thought ahead: Definitely contrast credit scores. Dictate a spending plan which can work for both of you. Imagine opening up a joint savings account to place deals on.

While you both could be located in your house to each other, just one carry out sooner need title toward assets. This new name is really what e could well be towards the action. This enables the master to deal with what will happen to your assets from inside the a passing. For those who have only control, you can make use of get off the home to anyone who you prefer.

To acquire a home inside Fl being hitched do not associate to each other. So why do you want to buy property as opposed to your own partner? You can find a few factors as to why you really need to believe making the wife or husband’s name from the mortgage. Manage Possessions Credit scores Money Account

Uphold Assets

Your home is a secured asset, and is confiscated in a number of extreme cases. Should your lover features defaulted student loans, possess delinquent fees otherwise delinquent decisions, he/she may potentially be prone for house confiscation. To shop for a house on your own title merely can safeguard you against creditors.

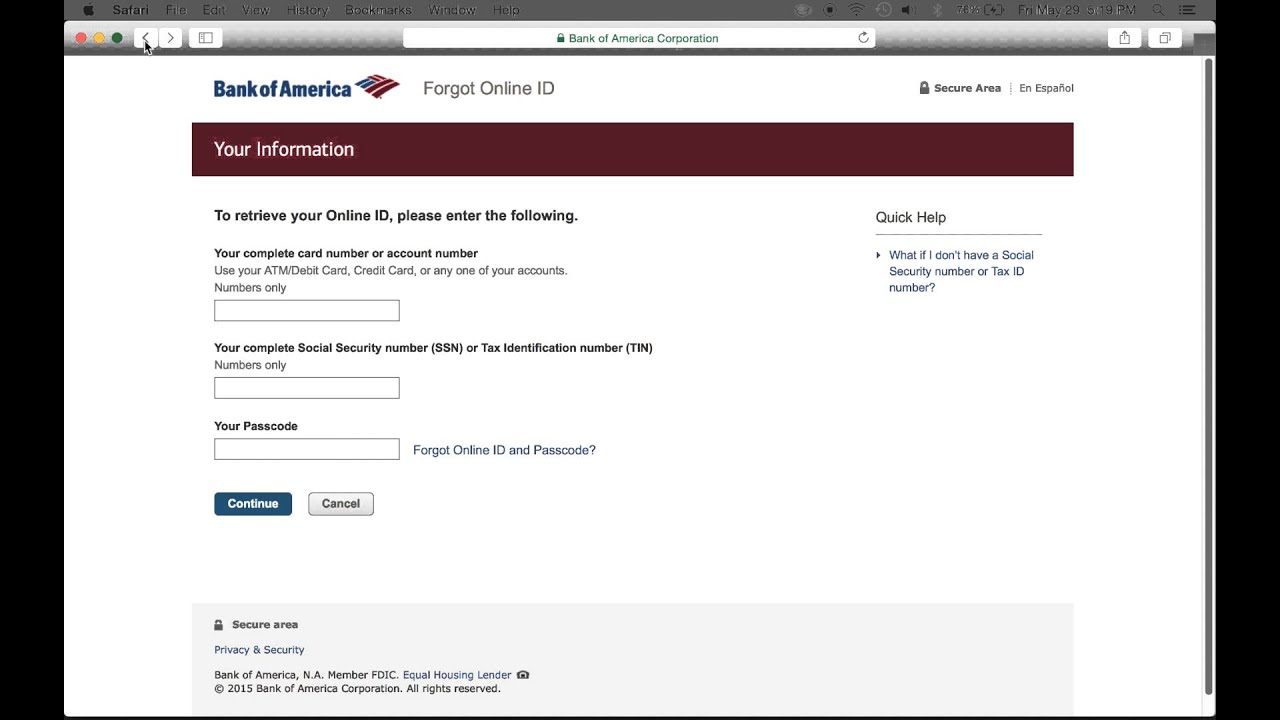

Low Credit score

If this is the way it is, your spouse would be stopping you moving forward regarding very best rates. You may want to get-off your lady off of the financial to the this, except if your own wife or husband’s money is needed to qualify for a proper financing.

Lower income

Whenever completing home financing application, you happen to be asked to show your source of income. More often than not, this means bringing W-2s and you can paystubs. If for example the mate doesn’t meet the criteria otherwise hasn’t got an excellent secure particular work over the past a couple of years, this will would difficulties being qualified for a loan. Should your mate lacks income but i have loans, this can throw off the debt-to-money proportion, and therefore sooner can prevent you from being qualified.

Mutual Bank account

If you have a http://clickcashadvance.com/loans/disability-payday-loans shared savings account created on the label and your spouse’s title and you are clearly choosing to purchase assets in place of him/their unique, you could potentially nonetheless make use of the account. This may maybe not hold since problematic that the account are owned by anyone else who isn’t on loan. Provided the name is on the account and it’s really your money, playing with a shared account should not carry out people circumstances.

There are many reasons to adopt maybe not incorporating their wife or husband’s label to the mortgage otherwise identity regarding property. Its entirely acceptable purchasing a house versus your wife. If you opt to fly unicamente otherwise thinking of buying a good house with your own companion, make sure you evaluate every financial items ahead of time. From the Florida Realty Marketplace, the audience is right here to find a very good home loan and you may financial choices to purchase your brand new home. Contact us today!