nine cues debt consolidation reduction into your financial might possibly be right for your requirements 1 noviembre, 2024 – Posted in: cash loans payday loans

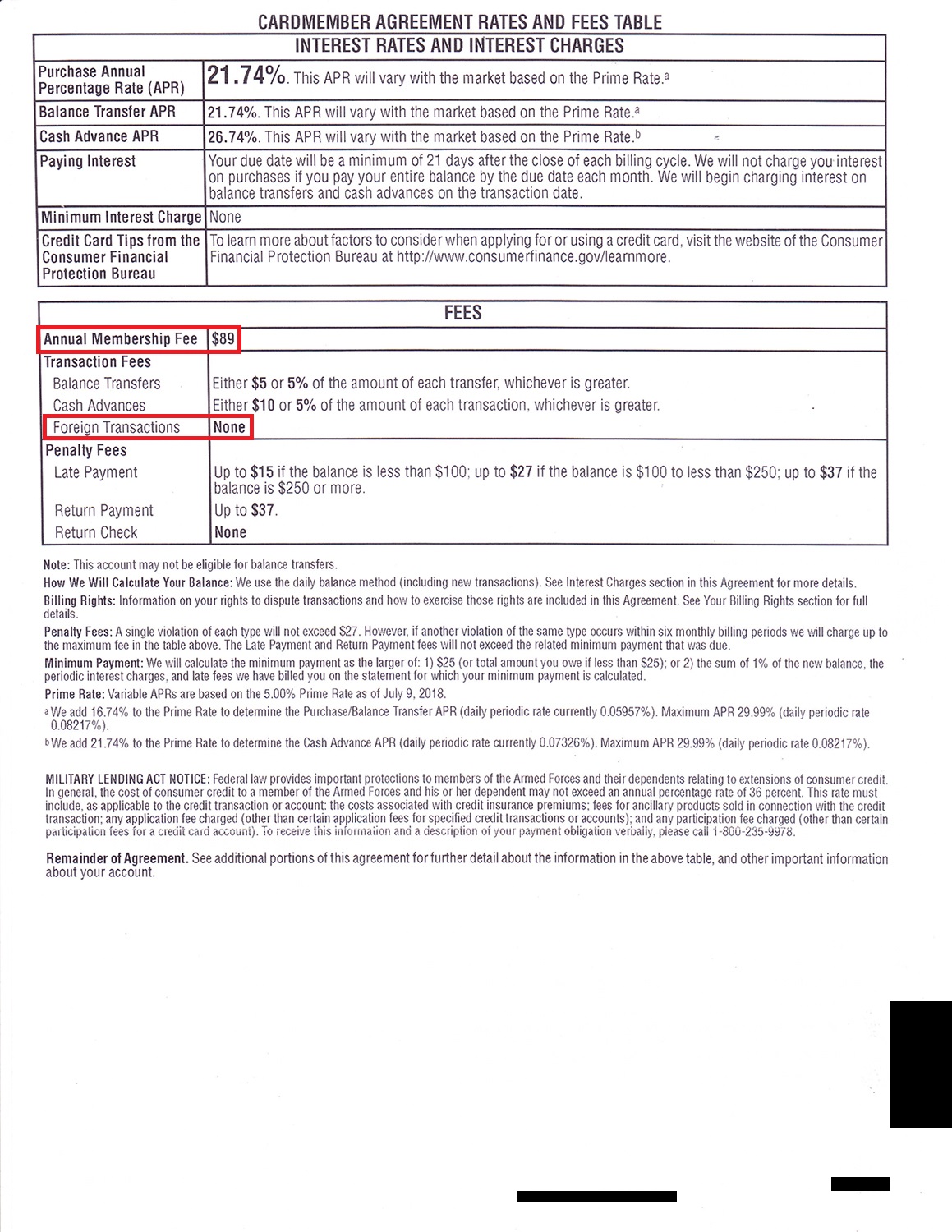

Such as for example, here is how it can move to pay a great $fifty,000 loans more five years against. two decades in one interest rate out of 6.3%:

Perhaps you have realized, if you are stretching the loan term is lower monthly money, they have a tendency to causes notably highest overall interest will cost you throughout the long term. However, if the a smaller loan title will make it hard to get to know your payments, purchasing a great deal more during the attention is probably a much better choice than simply risking standard.

Simultaneously, whenever you can manage to build extra money on the home financing, you could offset this perception over time.

2. Your home is on the line

After you combine unsecured debts (particularly handmade cards otherwise unsecured loans) into the home loan, men and women bills become covered facing your house. This is why if you can’t keep up with your mortgage costs, your own lender you may repossess your house to recuperate their losings.

step 3. It takes offered to settle your house

Of the merging obligations into the home loan, you happen to be raising the amount owed at your residence. This will stretch committed it requires to totally pay back their financial, postponing pressing right back any requires to be mortgage-100 % free.

cuatro. You might be lured to tray up a lot more obligations

While you are consolidating can get reduce your monthly obligations, additionally, it may succeed enticing to make use of borrowing again. This will do a routine away from accumulating so much more loans on the top of one’s home loan, potentially getting you in the a tough finances much time-term.

Should your obligations is related so you’re able to a dependency, you will need to seek let for the dependency and you will monetary circumstances prior to combining. Totally free tips such as the Federal Alcoholic drinks or any other Drug Hotline (1800 250 015), the fresh National Playing Helpline (1800 858 858), plus the Federal Debt Helpline (1800 007 007) are around for bring assistance.

If you’ve acquired that it far and still think consolidating the personal debt into your financial ‘s the correct flow for you, listed here are 9 cues you will be ready to exercise.

Importantly, this is simply not monetary recommendations and you’re advised to seek the brand new help of an independent monetary coach if you’re considering consolidating your own loans.

step 1. You might be incapable of perform several highest-appeal debts

For those who have multiple expense, like credit cards or signature loans, rolling them into your financial is also clear up your payments from the merging that which you towards you to definitely lower-attract loan.

2. You happen to be invested in maybe not adding so much more loans

Consolidating consumer debt into the financial comes with risks, and it is crucial that you avoid trying out the debt a while later. If you don’t, could cause inside a worse financial position, with both a larger mortgage and extra costs to manage.

3. Your own home loan rate of interest is lower than your almost every other costs

Mortgage rates is less than those of borrowing from the bank notes otherwise signature loans. By the combining, you could reduce the overall interest you’re spending towards an excellent day-to-date basis. Although not, keep in mind that you might become investing far more interest altogether due to the expanded Source lifetime out of a home loan.

4. You have got sufficient equity of your house

So you’re able to combine other expenses to your financial, you’ll need to has actually built up adequate domestic collateral you have access to the desired loans.

5. We need to decrease your monthly premiums

Merging debts into home financing generally stretches the latest repayment name off the borrowed funds, that may decrease your monthly payments that assist to free up earnings.

6. You are sure that you can spend more focus complete

The rate for the home financing is normally less than you to on the other forms out-of loans. Although not, as the mortgage brokers are apt to have lengthened loan terms than just unsecured loans and wants, one consolidating personal debt with the home financing could end up expenses a whole lot more desire through the years than simply it if not might have.