Home loan EMI Calculator 2024 Free download Do just fine Sheet 11 febrero, 2025 – Posted in: loans not payday for bad credit

Obtain the brand new totally free Do just fine Financial EMI Calculator in which include mortgage prepayment at regular (monthly or yearly) otherwise unusual wavelengths (lump sum). As well as, you should check the new a great loan harmony immediately after a certain period off tenure.

Note:- Do you want to prepay your property loan very early? I quickly has given specific methods and you will which is ideal for one prepay at the beginning of my personal newest post. You could refer an equivalent from the Prepay Home loan Calculator Free download Excel Piece.

Home financing is one of the longest forms of your partnership. And this, definitely, individuals find the advantages and you can cons of committing to for example long-identity funds.

Nowadays financial institutions is actually desperate to give you almost up to ninety% of cost of the house since loan amount. However, if you are rejoicing having such also provides, after that think twice.

# Prepayment out of home loan enjoys

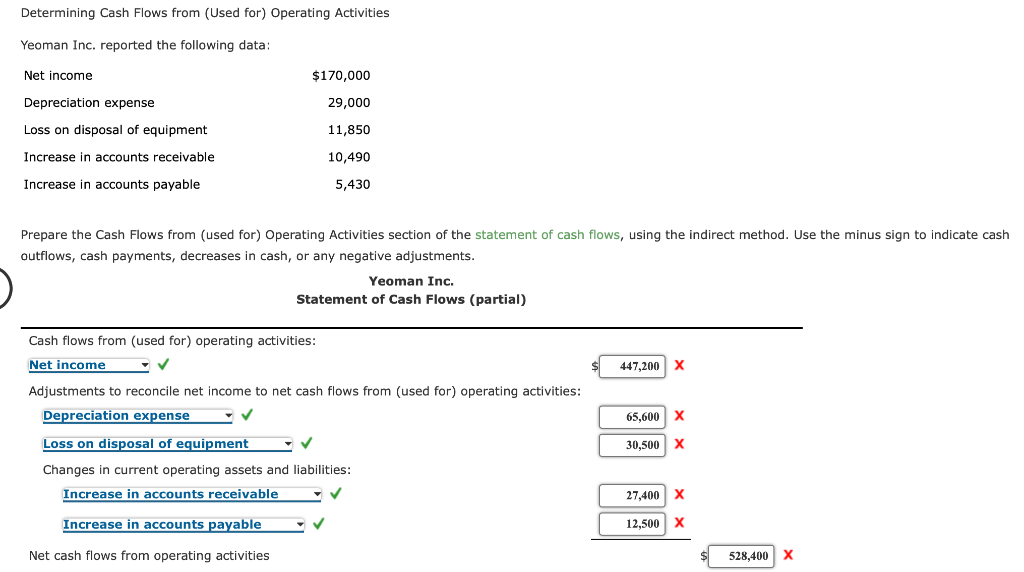

Right here, you really have possibilities such when you need to begin with prepayment, the total amount you want to prepay, how many times you want to prepay, and you may additionally, do you need to add any annual prepayment in addition to. Eventually, for this reason prepayment, simply how much focus outgo, you spared in the mortgage period?

# Dominating and you will Focus paid after a selected several months

Right here, you can examine after given many years exactly what the complete attention paid down, balance reduced, and also the outstanding principal equilibrium are.

# Analysis away from Prepayment and you will instead prepayment

On over a couple of dining tables, you’ll be able to contrast the outcome from prepayment from a property loan Versus a normal mortgage.

# Element to incorporate unpredictable prepayment

Plus the repaired payment alternatives such month-to-month (or as per the choice) and you may annual, you’ve got the substitute for enter irregular costs.

Install Home loan EMI Calculator 2023 100 % free Do just fine Sheet

Inside excel, you may have 2 kinds of amortization dining tables. You’re for many who decide for prepayment as well as typical family financing EMI and something a person is normal mortgage amortization.

# Some unanticipated risks of committing to long-label home loans

When you’re to own a home loan, next i always believe the latest EMI was safe for your money range and this will are an identical forever for your requirements. Yet not, during your financing period, it is possible to face certain asked risks. Let us discuss these types of.

We are all regarding the incorrect perception which our earnings is restricted. Although not, due to the financial crisis, you can even deal loan places North Courtland with occupations losings otherwise a plunge on your earnings (while mind-employed). And this, curently have the master plan to stand like things. An informed example to arrange is having enough disaster corpus (ideally up to six-a couple of years of month-to-month costs such as the EMI part plus).

It is with respect to the savings otherwise slowdown in your field. Yet not, imagine if your deal with people health problems and they are unable to do your duty? Therefore, to possess very long time or permanently you will possibly not get into a posture to make. Even though this might look a little bit exaggerated but planning to possess including situations is even top.

Because you are committing towards drifting speed funds, afterwards for individuals who deal with a situation like high rising prices and you will higher prices, you then have to have an acceptable shield to face including a great abrupt upsurge in your house mortgage rates of interest. And that, staying around 10% most amount together with your regular EMI are a better idea than simply toning your month-to-month finances.

The latest abrupt death of your house loan borrower feels like a great huge weight overall family. And this, usually pick correct life insurance coverage to cover for example obligations.

Many of us possess a wrong belief whenever banking institutions try providing us with financing, then the possessions automagically was affirmed. This isn’t the truth. You may also pick of numerous days where banking institutions considering finance having illegal qualities as well as. Hence, it is usually best to get own checklist regarding the legality of the property.

Finally, no matter what the interest stage was, I always believe that Liability is always an accountability. There are no a or bad liabilities. It may be my solution. However, I love to live a debt-totally free existence in lieu of work with anyone else. You may also differ from my personal views.

Subsequently, let us search greater to your such as what’s the most practical method to pay off your house loan. This is an effort so you can explain their misunderstandings concerning the house mortgage. I did so my personal best in making sure that the new calculator is actually error-free. Although not, for many who found any, upcoming delight suggest myself.