A preliminary business is going to be most readily useful to own residents than foreclosure, undertaking shorter problems for your credit score 3 febrero, 2025 – Posted in: american cash advance usa

For many who owned a house anywhere between 2006 and 2011, there can be a high probability you saw your own home’s value bitter off most of the-date levels to all or any-big date lows. During the 2012 by yourself, short sales accounted for twenty two per cent of the many family purchases.

What is an initial profit?

A primary selling is the income out-of property where new continues are lack of to repay every home loan balance against the possessions.

When there is more than one lienholder to your assets, a first an additional financial, like, it is important that most lienholders agree to deal with below extent due once the fee-in-full.

Brief purchases wishing periods rely on the kind of loan your seek. In general, government-backed mortgages be more flexible than traditional financial guidance.

not, you will find several low-primary software that can accept you someday regarding property foreclosure if one makes a hefty advance payment and you may pay a top mortgage rate.

Non-QM home loan once a short sale

Borrowing qualifying conditions getting low-QM finance are different, but many lenders promote low-QM finance an individual day trip regarding a short product sales.

Very non-QM financing apps bring high interest rates and need huge off payments. Talk to a non-QM home loan company regarding degree standards.

FHA: No waiting months

FHA lets homeowners to apply for a home loan once a small selling. It is very important note, not, that FHA’s no prepared several months features several tight caveats.

- You had been not into the standard into the past mortgage within period of the quick product sales, and you will

- Throughout the 1 year prior to the quick sale, you made your mortgage payments punctually.

When your mortgage was at standard during the time of the latest short sale, FHA demands a beneficial about three-season prepared period before you apply to possess another type of home loan.

FHA home loan immediately after a short income

- The fresh new big date of your brief marketing, Or

- In the event your early in the day mortgage was also an FHA-insured financing, on the big date you to definitely FHA paid off the brand new claim with the brief income.

If you can reveal extenuating items was the cause of financial default, you will be capable meet the requirements earlier than the 3-seasons period.

- Splitting up (some times)

- Serious illness otherwise loss of a member of family, constantly within number one salary earner, or

- Occupations loss, once again always between your number 1 wage earner

Compliant loan immediately following a short revenue

Homebuyers seeking to put lower than 10 percent off requires to wait eight years from the big date of the small selling.

Discover exceptions with the typical waiting periods getting a conventional financing. In order to be eligible for these types of exceptions, you desire the absolute minimum downpayment out-of 10 percent, and authored facts the short marketing try caused by extenuating circumstances.

Without constantly since ruining https://paydayloansconnecticut.com/bethlehem-village/ since a foreclosures, an initial income will get damage your borrowing from the bank. This will depend on what your negotiate together with your lender. Specific doesn’t declaration it should your citizen helps make limited restitution to fund a number of the lender’s losings.

If for example the small sale try reported since a critical delinquency or derogatory product, it does stay on their record for up to eight ages.

Tune your own borrowing from the bank

Quick sales usually appear on your credit score because the Paid/closed that have no harmony. There may additionally be the fresh new notation, compensated for less than full balance.

Often banking institutions get this to incorrect and you will statement brief transformation inaccurately. It is crucial that the short business are revealing to your credit bureaus accurately.

Rebuild your borrowing from the bank

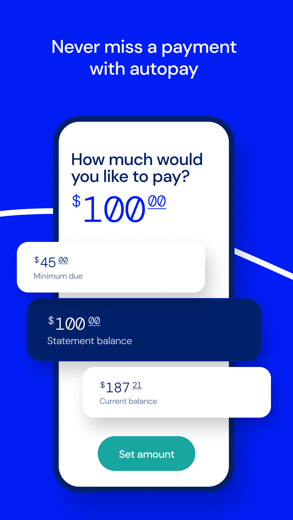

Repairing your own credit concerns opening the newest credit accounts and you may using all of them timely for a minimum of 1 year. Remain all of the profile discover and you will outlay cash entirely each month.

Secure credit cards will likely be a replacement for antique credit cards. Select one carefully, even if. Specific only gather steep fees and supply little work for. Covered notes simply rebuild borrowing whenever they declaration the records to help you credit agencies.

You may want to change your credit score due to the fact a keen authorized member. It means you’ve got nearest and dearest or family members that have excellent that are willing to add one to its accounts once the a 3rd party representative.

Discover your credit rating

Centered on a current survey, forty per cent regarding people hardly understand the importance of credit results in making borrowing behavior.

There are certain issues that make up the borrowing ratings, such as for example fee records, ages of membership, form of account and level of credit issues.

Just what are The current Financial Rates?

Regardless of if you’ve had a primary sale on your own recent years, you may still qualify for a minimal deposit, a reduced price, and you will a low month-to-month homeloan payment.

Learn current financial costs today. Zero personal safety matter must start, and all sorts of prices include usage of the live financial borrowing results.