5th Third Lender financial pro answers audience inquiries 18 noviembre, 2024 – Posted in: advance america cash loans

Express that it:

- Click to share with you to the LinkedIn (Reveals when you look at the the new screen)

- Simply click so you’re able to email address a link to a pal (Opens into the the latest windows)

Score the mid-day newsletter provided for your inbox!

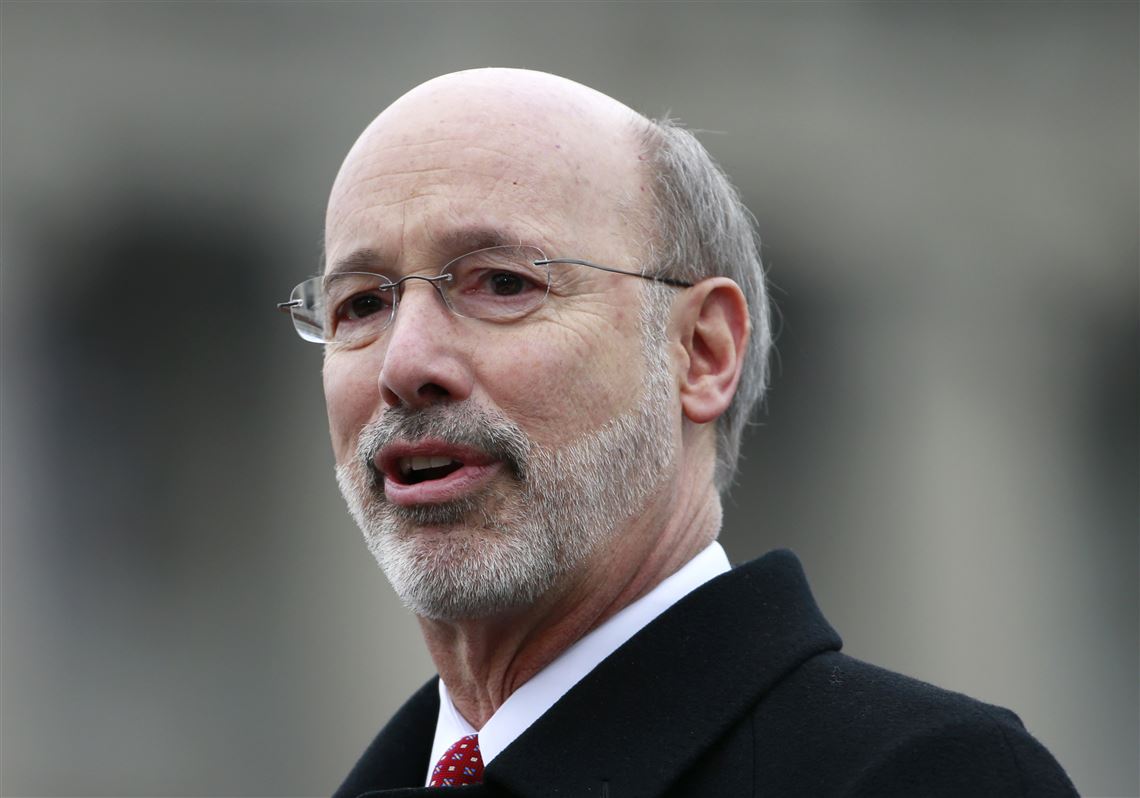

For the past six months, QCity Urban area possess questioned clients add their property-to find questions. Lower than, Tori Calhoun, a senior mortgage inventor on Fifth 3rd Financial, will answer such concerns. Calhoun could have been within 5th 3rd for more than 13 decades and has now set some consumers within their fantasy homes.

Tori has had new President’s Community Award that is constantly good Rare metal Ideal Vocalist within 5th Third. She brings a vast number of financial studies to her users that is able to overcome affairs, challenges, give guidance, and you can familiarize yourself with for every single finances to be sure it’s the top fit for for each buyer’s need. Tori was local on the Charlotte town features lived-in New york all their unique lifestyle.

I wish to let my mature child inside to purchase an excellent possessions. Which of these options is best: Can i feel an effective co-signer for the mortgage, meaning both my personal label and you can hers would-be towards action? Otherwise, ought i provide the fund she needs for a deposit/closing costs with only her term on the financial? My personal credit rating (800s) is higher than hers. My home is Charlotte; she lives in Maryland. The house my personal child commonly purchase have been in Maryland, in which she’s existed over the past 3 years. The woman is leasing here, i am also leasing now within the Charlotte. We offered my condo from inside the Charlotte from inside the , and so i keep in mind that I might be considered a first-day homebuyer since the more than 36 months keeps elapsed because control.

That’s really large of you to simply help their child which have their first house pick! She actually is a lucky woman! I would recommend option 2, for some causes. If for example the de, it would be best to allow her to do this rather than jointly taking on your debt and responsibility to repay they. When you co-sign your loans, that debt gets element of debt financial obligation. By allowing her take action on her individual, you are not guilty of the debt, neither is it possible you incur one borrowing derogatory is always to she standard to the the mortgage. This is the best way to make sure you keep the 800+ credit rating while keeping your financial loans lower. In addition enables you to are still eligible to become an initial-date homebuyer once again and perhaps benefit from first-date homebuyer apps as you are already leasing also and you can tends to be searching towards the home ownership once more down the road.

Credit rating versus financial applications

A mortgage borrowing from the bank query is considered an arduous inquiry. It include a research of the around three credit reporting agencies – Experian, Equifax, and you may Transunion. Generally speaking, the perception are smaller than average short-term. Just how many facts does are very different between for every bureau, for each and every customer, and their full credit rating. Centered on FICO, a challenging credit query will get rid of your credit rating between step one and you will 5 activities. When looking for home financing, it is best to take action inside a thirty-date windows. Extremely credit reporting models have a tendency to matter https://paydayloancolorado.net/holly/ numerous concerns all together, which helps get rid of this new effect also.

I am crazy! You will find an excellent credit history and two recognition emails out of lending organizations. Nevertheless the price of our house I would like so increased you to it is higher than the significance, so i have to put together the difference? Is it legal? Our home will certainly perhaps not appraise for this amount? Wink wink! Help! I wish to purchase property.