Within the Oklahoma, nearly fifteen,000 home loans was in fact fully acknowledged 30 octubre, 2024 – Posted in: can i get cash advance with no credit

Maximum mortgage constraints vary by the county

- Texts

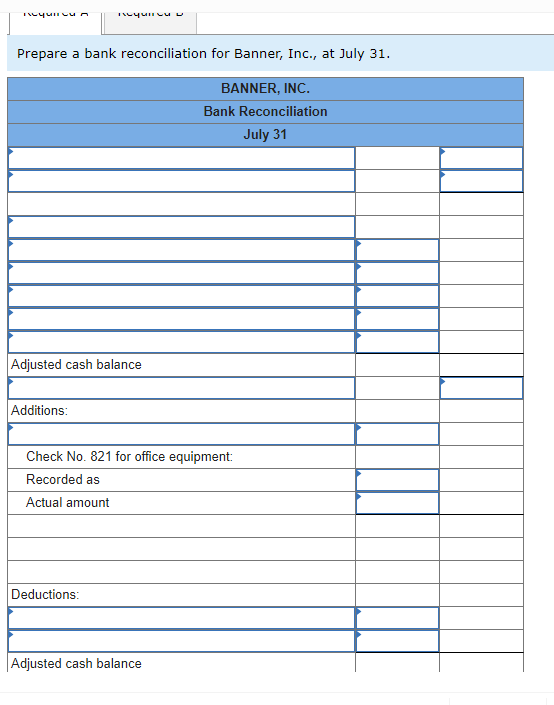

A map of your United states indicating Point 184 mortgage approvals within the per state since , the most recent map the latest Construction and you will Urban Development possess. Homes And you will Metropolitan Invention

Restriction mortgage constraints are very different of the condition

- Texting

- Printing Content blog post connect

Limitation financing limitations differ of the county

- Text messages

- Print Backup post connect

TAHLEQUAH, Okla. — Of several Local People in the us may qualify for mortgage brokers via a beneficial You.S. Homes and you may Urban Invention program that’s existed for over a couple of years. New Point 184 Indian Mortgage Ensure System has versatile underwriting, is not credit-get centered that is Native-specific.

Congress situated they within the 1992 in order to support homeownership within the Indian Country, and many of its benefits become low-down repayments and no private home loan insurance coverage.

“I recently envision it is an excellent system, and i ordered my domestic doing this,” Angi Hayes, that loan founder to have initial Tribal Lending inside Tahlequah, said. “I recently think it is so great, (a) system that more some one should know and of course the fresh tribes should know.”

“In which I really works, we have been many educated all over the country, and thus i manage so much more (184 finance) than most likely all other financial,” Hayes said. “There’s a lot of causes that it’s most likely much better than FHA (Government Houses Management), USDA (U.S. Service regarding Farming) or old-fashioned financing. A lot of times it is reduced at the start. Including, FHA is going to cost you 3.5 percent off. I costs dos.25 %.”

Hayes said into the Oklahoma the most mortgage she will be able to already promote was $271,050. “The latest borrower try presenting that most other dos.25 percent, and so the $271,050 is not the biggest purchase price you can get, it is simply the biggest amount borrowed I can perform.”

“Which is probably the most significant misconception on the 184 mortgage, that usually getting associated with the tribe or which have standing as the Local American, they usually are a minimal otherwise modest-money situation,” she told you. “The wonderful most important factor of the brand new 184 is the fact this is not low-earnings and is also not simply to own earliest-day homebuyers.”

Hayes said if you are HUD doesn’t require a certain credit history to meet the requirements, she means a credit report to choose an applicant’s debt-to-earnings ratio. She also means shell out stubs, taxation and financial statements and at least a couple of types installment loans in Missouri of borrowing from the bank with 1 year worth of adopting the.

“I could share with everyone I am not saying a credit counselor, but because of the way we manage all of our approvals, once i remove borrowing I’m looking at the animal meat of report,” she told you. “Essentially, you put your earnings while the loans on the credit file and you also include it with the latest advised family fee. Both of these something to one another can’t be over 41 percent out-of the full gross income. That’s how i determine how far you are recognized for.”

“I’m wanting no late money during the last 12 months,” she told you. “Judgments, you should be 2 yrs out of the go out it was filed and you can paid. We are in need of no series having stability if you do not keeps proof you to you really have repaid at the least 1 year with it. When you need to look at it commonsense, the things i give people would be the fact we don’t should hold your crappy history against you.”

The new 184 loan even offers a reduced down-payment dependence on 2.25 % to possess financing more than $fifty,000 and you can step 1.25 % to possess loans less than $fifty,000 and you can costs .25 % annually for personal home loan insurance policies. Given that financing well worth is at 78 %, the insurance coverage will likely be fell. The buyer as well as pays one, step one.5 % mortgage commission, which is paid in dollars it is constantly additional towards the loan count.

“Easily keeps individuals walk in, We basic need certainly to find out what the needs are,” she said. “In case your borrowers want to incorporate themselves, I’ll give them the various tools that they need to know when they are willing to get. Once they just want to manage a much get, I extremely advise people to rating pre-accepted just before they look at the property, simply because is deciding on a thing that try method over or method significantly less than their finances.”

The borrowed funds could also be used in order to re-finance a current home mortgage, Shay Smith, movie director of one’s tribe’s Business Guidance Cardio, told you.

A different attraction is that it can be shared on the tribe’s Financial Direction System to have home orders. The fresh new Map facilitate customers get ready for homeownership that have custom credit courses and classroom studies while offering down-payment direction anywhere between $ten,000 so you can $20,000 to own very first time homebuyers. Yet not, Chart people need see earnings advice, feel first-go out homeowners, finish the necessary documents and you will programs and you can complete the homebuyer’s training groups.

The office out-of Loan Make sure inside HUD’s Work environment of Indigenous American Software pledges this new Point 184 mortgage loan finance made to Native borrowers. The borrowed funds be certain that guarantees the lending company you to definitely their investment could be paid down completely in case there are foreclosures.

The new borrower applies to your Point 184 mortgage which have an using financial, and deals with this new tribe and you can Agency from Indian Factors when the rental tribal residential property. The lending company after that assesses the desired loan papers and you may submits new financing to have recognition in order to HUD’s Workplace from Financing Guarantee.

The borrowed funds is restricted to unmarried-family homes (1-cuatro gadgets), and you may fixed-rates fund to own 30 years from reduced. None adjustable speed mortgages (ARMs) neither commercial buildings are eligible having Part 184 funds.

Funds need to be made in an eligible city. The application has expanded to incorporate qualified portion beyond tribal believe property.